SERVICES

M&M offers professional revenue cycle management services by working on exact and accurate figures with no lapse. We perform the following primary operations..

Build your practice on healthy relationships. Let our expertise facilitate your relationships with insurance companies as well as patients, allowing you to serve more patients, serve them better, and attain the highest reimbursement rates.

Credentialing and contracting are the bases of starting a clinic or healthcare facility, and it lays the foundation for your relationship with insurance companies as well as patients. We obtain and negotiates contracts with insurance payors, as well as taking on the responsibility of making sure your facility or physician’s contracts with insurance carriers are up to date.

Patient insurance eligibility verification is the first and perhaps most critical step in the billing process. That means your service provider has to be on the ball to obtain and accurately record all eligibility information. Our focus is on preventing denials and avoiding delays in payment by providing quality RCM services, which will boost revenue at time of service, save time on the back end, and also enhance patient satisfaction.

Patient insurance eligibility verification is the first and perhaps most critical step in the billing process. That means your service provider has to be on the ball to obtain and accurately record all eligibility information. Our focus is on preventing denials and avoiding delays in payment by providing quality RCM services, which will boost revenue at time of service, save time on the back end, and also enhance patient satisfaction.

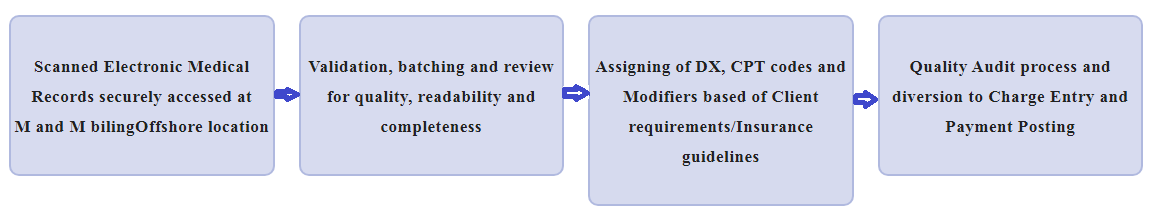

At M&M, we offer quality medical coding services to healthcare providers, hospital clients and Ambulance services. With a 24 to 48 hours or TAT our comprehensive medical coding solutions are aimed at drastically improving the efficiency and effectiveness of your coding department. We are fully compliant with all of the Correct Coding Initiatives (CCI) and Local Medical Review Policies (LMRPs).

At M&M, we offer quality medical coding services to healthcare providers, hospital clients and Ambulance services. With a 24 to 48 hours or TAT our comprehensive medical coding solutions are aimed at drastically improving the efficiency and effectiveness of your coding department. We are fully compliant with all of the Correct Coding Initiatives (CCI) and Local Medical Review Policies (LMRPs).

Our coding teams, many of whom CPC, CPC-H and CPC-P accredited by the American Academy of Professional Coders (AAPC), they have proficiency in the following code sets and usage guidelines; CPT-4, HCPCS, ICD-10-CM, LCD/NCD and CCI EDITS.

To ensure a high level of accuracy, our QA Department continually monitors the coding accuracy and their efforts are supported by appropriate documentation from our clients to provide maximum and accurate reimbursement.

OUR CODING PROCESS

Charge entry is one of the key areas in medical billing. In the medical billing charge entry process, created patient accounts are assigned with the appropriate $ value as per the coding and appropriate fee schedule. The charges entered will determine the reimbursements for physician’s service.

Charge entry is one of the key areas in medical billing. In the medical billing charge entry process, created patient accounts are assigned with the appropriate $ value as per the coding and appropriate fee schedule. The charges entered will determine the reimbursements for physician’s service.

Therefore, care should be taken to avoid any charge entry errors which may lead to denial of the claims. Moreover, good co-ordination between the coding and the charge entry team will produce enhanced results.

The payment posting process, in many ways, provides insight into the performance of your revenue cycle. It allows you to understand and analyze trends in reimbursements. Accurate payment posting gives you clarity about the status of your revenue cycle, so you can choose the most efficient team to take over the payments processing.

Our Payment Posting Process

We process various types of remittances received with high degree of accuracy, improved responsiveness and follow procedures defined by our clients. We provide the followingservices:

Patient Payments Posting:

- We receive information from our clients during patient services. These payments are made by cash/check/credit cards and may be on account of co-payments,deductibles or non-covered services. Our team reviewed the information received and reconciled it against each patient account.

- On the other hand, we receive information from our clients after we send

statements for patient balances. Our team can handle the patients’ statements, and post payments if pay. FYI: If the patient doesn't pay after we send the statements, we transfer the patient's balance to a Collection Agency. But it only depends on the clients.

Insurance Posting:

We process insurance payment in the following ways:

- Electronic Remittance Advisory: We receive a large volume of ERAs from payers and batch process them by importing them into our clients& practiceanagement system. Every batch run throws exit exceptions and we fix the same withbatch totals check. If not posting automatically; we’ll find out and fix where the issue is.

- Manual Posting: Our customers often send us scanned EOBs. Each EOB module is accessed through secure FTPs or through the EHR system and processed according to the client's business rules for adjustment, write-off and balance transfer to secondary insurance companies or patients.

Denial Posting and Action:

- Posting claim denials is essential to get an accurate understanding of the

clients’ A/R cycle. Denied claims are reviewed based on ANSI codes and sent back to payers. We understand payer-specific denial codes for all the payers and specialize in understanding ANSI standard denial codes. - Furthermore, sometimes the payer has certain medical guidelines; likewise,we will check the guidelines, fix the claims and resubmit with necessary information and it is up to the payer.

- We notate each claim denial and the actions part in the Practice Management System to find out why the claim has not yet been paid and what actions have been taken.

“Our goal is to collect what is due to the Provider in an ethical and professional manner”

Maintaining a steady flow of revenue is crucial for the successful operation of a healthcare provider. At M&M, we provide effective accounts receivable services for the healthcare industry, to shorten the revenue cycle and improve your cash flow. We provide an end-to-end solution for accounts receivable, where we identify outstanding accounts, follow these up and take the necessary action to collect unpaid claims.

Maintaining a steady flow of revenue is crucial for the successful operation of a healthcare provider. At M&M, we provide effective accounts receivable services for the healthcare industry, to shorten the revenue cycle and improve your cash flow. We provide an end-to-end solution for accounts receivable, where we identify outstanding accounts, follow these up and take the necessary action to collect unpaid claims.

Our goal is to recover outstanding funds in the shortest possible time. The services we offer include:

Denial Management : We deliver a thorough analysis of denied claims in terms of billing, registration and medical coding and determine if any errors have occurred. For claims that require an appeal, we prepare the appropriate letters, along with the supporting documentation.

Follow up with Insurance Carriers: Our team of accounts receivable professionals scrupulously follow up unpaid and underpaid debts with insurance companies. Our agents are continuously communicating with insurance providers by both phone and email, to ensure that debts are settled swiftly.

Follow up with Patients: We analyse and identify patients with outstanding accounts and take the appropriate action to finalize these accounts.

Reduce Bad Debts and Fast Track Your Revenue Cycle

M&M boasts extensive healthcare accounts receivable experience and has the capability to drastically enhance your revenue cycle. Our proven services shorten the turnaround time on your receivables, while improving the relationship with your patients.

“By taking charge of your Credit Balances, M&M can expeditiously decipher, process and post refunds and/or account corrections to consistently ensure the overall integrity of your revenue cycle”

All M&M analysts are diligent and well trained to ensure that outstanding credit balances are accurately resolved in an expeditious manner. We understand that a professional and cooperative environment is the key to resolving more credit balances, many of which become ‘account corrections’ as opposed to actual ‘refunds’; hence, our operational model is highly client-centric.

All M&M analysts are diligent and well trained to ensure that outstanding credit balances are accurately resolved in an expeditious manner. We understand that a professional and cooperative environment is the key to resolving more credit balances, many of which become ‘account corrections’ as opposed to actual ‘refunds’; hence, our operational model is highly client-centric.

Highlights of our Solutions:-

- Analyse accounts along with EOBs

- Work all assigned accounts big and small balance alike

- Resolve all accounts inspect for patient liability or other adjustment issues

- Determine if Double payments were made if so, refund is required

- By patient and insurance carrier

- By 2 insurance carriers (Both acting as Primary)

- Check for duplicate Payments made for same account

- Many Credit Balance analysts have earned or are earning the designation of Certified Patient account